south dakota property tax laws

Most of South Dakotas property tax laws are codified in various chapters of Title 10 of the South Dakota Codified Laws. Based On Circumstances You May Already Qualify For Tax Relief.

South Dakota Codified Laws 10-18.

. CHAPTER 10-18 PROPERTY TAX ABATEMENT AND REFUNDS 10-18-1 Invalid or erroneous assessment or tax--Claims for abatement or refund-. Tax delinquency is increasing steadily in South Dakota. How Property Tax is Calculated in Yankton South Dakota.

Laws 43-15A-1 et seq. Tax amount varies by county. The Act governs condominium associations that expressly elect to be governed by the Act by recording a.

The last thing you want to deal with is missing a tax payment. Legislative Research Council 500 East Capitol Avenue Pierre SD 57501. Taxpayer Bill of Rights.

Property Tax Codified Laws. Tax Breaks and Reductions. Ad See If You Qualify For IRS Fresh Start Program.

Look Up Any Address in South Dakota for a Records Report. This system features the Property Tax Explainer Tool that provides a. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws.

Large areas in the state have simply ceased to carry property taxes and are publicly owned. If someone from another state leaves you an inheritance check local laws. The South Dakota Property Tax Portal is the one stop shop for property tax information resources and laws.

Businesses who would like to. Chapter 36-21A - Real Estate Licensing. So even money you earn from a.

Any municipality may impose an additional municipal gross receipts tax at a rate of 1 on the gross receipts of all leased or rentals of hotels motel campsites or other lodging. 128 of home value. The authority to levy property taxes The County Director of Equalization DOE assesses the.

The property tax system in South Dakota consists of two parts. Free Case Review Begin Online. 2022 - SD Legislative Research Council LRC Homepage SD Homepage.

Normally property tax is imposed by state county and municipal governments. South Dakota Condominium Law SD. Find a variety of tools and services to help you file pay and navigate South Dakota tax laws and regulations.

South Dakota Laws and Rules. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in. Welcome to FindLaws South Dakota Tax Laws section with up-to-date information for taxpayers in the For most Americans mid-April means that state and federal taxes are due.

See Results in Minutes. Statutes change so checking. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

SDCL 10-1 Department of Revenue. Yankton South Dakota calculates its property. Up to 25 cash back You can find South Dakotas property tax sale laws in Title 10 Chapters 23 24 and 25 of the South Dakota Codified Laws.

Sales and property tax refunds and property tax freezes are available to seniors. In this section you will find information about your rights as a tenant including the right to not be discriminated against in addition to homestead laws meant to prevent struggling homeowners. Administrative Rules of South Dakota.

This system features the Property Tax Explainer Tool that provides a. State law provides several means to reduce the tax burden of senior citizens. South Dakota Codified Laws SDCL Regulated by the Commission.

Ad Find Property Ownership Records from Any State with a Simple Online Search.

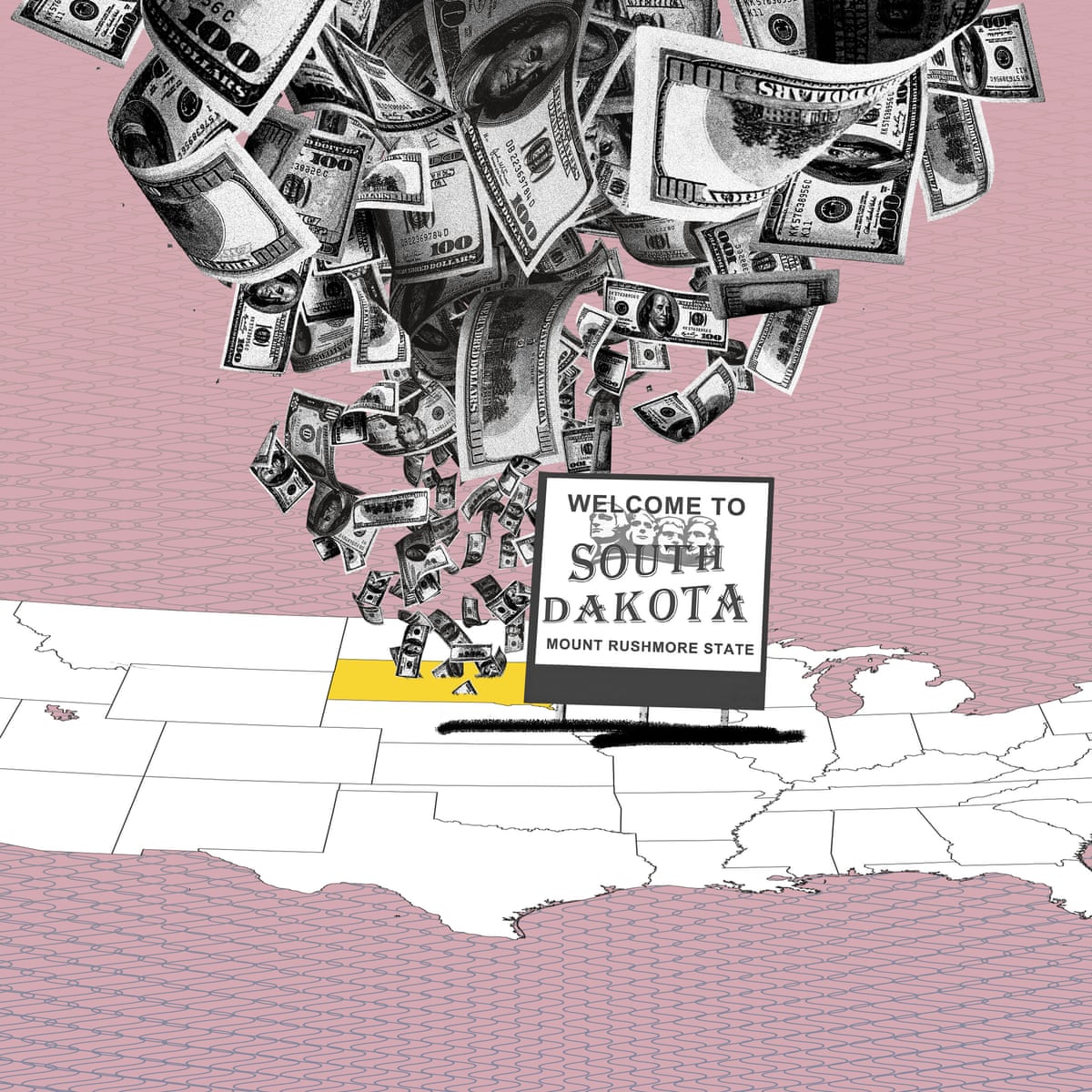

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Washington Quit Claim Deed Form Quites Washington Sheet Music

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

South Dakota Turned Itself Into A Tax Haven But Why

Property Tax South Dakota Department Of Revenue

Joint Venture Agreement For Two Parties Extensive Real Estate Joint Venture Model For Two Parties Owning Property As Tenant Templates Business Template Joint

We Are Offering Property Management Bungoma Service For Both Commercial And Reside Rental Property Management Property Management Property Management Marketing

Imgur Com History Notes Imaginary Maps Infographic Map

State Corporate Income Tax Rates And Brackets Tax Foundation

Colonial Quills How The Colonies Got Their Names Connecticut Student Loan Forgiveness Student Loans

Illinois Quit Claim Deed Form Quites The Deed Illinois

Washington State Month To Month Rental Agreement Rental Agreement Templates Agreement Washington State

14 States Don T Tax Retirement Pension Payouts Retirement Pension Pensions Retirement

Quit Claim Deed Quites The Deed Nevada

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning